Innovative Financing Mechanisms for the SDGs: Benin’s SDG Eurobond Experience

With the upcoming 4th International Conference on Financing for Development (FfD4) in Seville, Spain, financing for development is receiving increased attention from the international community. Funding remains largely insufficient, and developing countries are facing major challenges in achieving the Sustainable Development Goals (SDGs).

Traditional sources of funding, notably official development assistance (ODA), foreign direct investment (FDI), and remittances, are limited in volume and effectiveness. The recent COVID-19 pandemic exacerbated the issue, pushing back progress towards the 2030 Agenda and making resources scarce and unpredictable. According to estimates, the SDG financing gap amounted to $4 trillion in 2022–2023 and could grow to $6.4 trillion by 2030 if significant measures are not implemented.

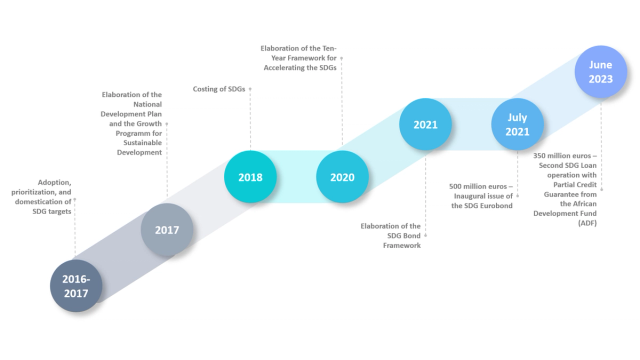

Innovative ways of mobilizing resources are crucial to overcoming the financing gap. Sustainable financing instruments, such as green, social, sustainability, and sustainability-linked (GSSS) bonds, sustainability and sustainability-linked loans, and ESG funds, among others, help diversify funding sources to support the achievement of the SDGs. Among developing countries, Benin stands as one of the pioneers in the mobilization of these innovative financing instruments. In July 2021, the country issued its first SDG Bond, amounting to €500 million, becoming the first African nation to leverage such an instrument dedicated to financing the SDGs.

New policy briefs produced by SDSN Benin, with contributions from the UN Sustainable Development Solutions Network (SDSN) and support from the Ministry of Economy and Finance of Benin, highlight the country’s experience in leveraging SDG bonds and loans to fill the financing gap. Benin’s experience can serve as an example to countries facing similar challenges.

Bridging the SDG Financing Gap: Benin’s SDG Eurobond

Benin’s pioneer SDG Eurobond brought an innovative and transparent approach for gathering large-scale resources for financing and accelerating the 2030 Agenda. In 2021, Benin established an SDG Bond Framework aligned with the International Capital Market Association (ICMA) Green and Social Bond Principles, ensuring targeted allocation of funds, transparent governance, and rigorous management. As a result, Benin raised €500 million with the initial Eurobond issue. In 2023, an additional €350 million SDG loan was carried out with the support of the Partial Credit Guarantee from the African Development Fund.

Our analysis demonstrates that Benin’s successful experience relies on the following key pillars (see Figure 1):

- A Strong Political Commitment Towards the SDGs: Before the SDG bonds issuance, Benin successively adopted and domesticated the 2030 Agenda, placing the SDGs at the core of its national development plan and other development programs, assessing the costs and its financing strategy to achieve the SDGs, and developing its SDG Bond Framework.

- Transparency and Accountability: Since 2016, Benin has committed to enhanced transparency and accountability with the markets, focusing on the quality of its credit profile. In 2023, Benin was ranked 2nd in francophone Africa in terms of budget transparency, as well as 1st in Africa and 7th worldwide on fiscal expenditures transparency.

- Partnerships: The Government of Benin called upon the SDSN, recognized for its international independent expertise, to: i) assist the country’s monitoring of performance and progress on the SDGs; ii) identify key data gaps and areas where research is needed; and iii) promote integrated solutions to achieve the SDGs, including capacity-building for local stakeholders. Since the beginning of the collaboration in 2021, three reports assessing progress, efforts, and weaknesses in achieving the SDGs have been launched on the occasion of high-level international forums, assisting the government’s decision-making.

Projects financed by the SDG Eurobond have led to significant improvements in access to drinking water, education, and clean energy, directly benefiting around 5 million Beninese. The SDG Eurobond greatly contributed to the following major outcomes, among others:

- Access to Drinking Water: Service coverage increased from 55% to 71.8% in urban areas, and from 42.0% to 76.7% in rural areas between 2017 and 2022.

- Access to Energy: The proportion of the population with access to electricity was 65.0% in 2021-2022, compared to 34.5% in 2018. The electrification rate reached 32.8% in 2022, compared to 29.2% in 2018.

- School Nutrition and Education: Access to the Government of Benin’s school meal program nearly doubled in three years, rising from 660,654 children in 2021 to over 1.2 million children in 2023, notably thanks to the “National Integrated School Feeding Program” (PNASI). In addition, nearly 1.8 million learners received scholarships, while 14,083 aspiring primary school teachers were recruited in 2023. As a result, primary school completion rate increased from 58.5% in 2018 to 61.8% in 2022.

A Successful Example: Financing School Canteen Programs to Support Students’ Academic Performance and Nutritional Well-Being

Malnutrition and school repetition have been long-lasting challenges for the education system in Benin, hindering the development of human capital necessary for growth and sustainable development. In Benin, around 30% of the kids could not finish primary school in 2022. In parallel, about one-third of school-aged children in Benin suffered from malnutrition in 2020, mirroring the trends observed in West Africa.

The SDG Eurobond became an essential funding source for the PNASI, launched in 2017, aiming to tackle these long-lasting challenges. Between 2021 and 2023, the PNASI received about $100 million from the SDG bonds resources. Between 2017 and 2023, the coverage rate of public schools benefiting from school meal programs increased from 32% to 75%. The program has been oriented to priority zones with higher vulnerabilities, hence following the leave-no-one-behind principle of the 2030 Agenda and the SDGs. In addition, a recent impact evaluation conducted by SDSN Benin in the Borgou and Plateau departments highlights PNASI’s effectiveness in lowering repetition rates by 26% and enhancing children’s consumption of iron-rich foods.

Lessons Learned and Ways Forward

Benin’s SDG Eurobond demonstrates how an impact-based financing instrument can simultaneously contribute to reducing the financing gaps and to implementing high-impact SDG-oriented projects, notably with the example of the PNASI in the education sector. Strong political commitment, transparency, accountability, and partnerships are also key in mobilizing financing and achieving the SDGs.

Since its 2021 SDG Eurobond issuance, some improvements are necessary to enhance the use and impact of the SDG financing instruments in Benin, including:

- Improving data availability, as initiated through the partnership with the SDSN, to fill the existing data gaps.

- Continuously improve governance, ensure rigorous internal controls, and provide capacity-building and training to administrators and project managers on expenditure eligibility criteria.

- Extending the use of innovative sustainable financing instruments, including sustainability-linked bonds (SLBs), and promoting operations in local currency.

The PNASI has demonstrated to be a program, supported by the SDG Eurobond resources, that can help reach important educational and nutritional outcomes. However, operational adjustments considering social and geographical disparities are needed to ensure positive and long-lasting impacts:

- In urban schools, adapt and balance nutritional quality.

- In rural schools, enhance the nutritional intake with educational and sanitary infrastructure improvements.

- Reinforce the collaboration between the local stakeholders participating in the PNASI and provide them with capacity-building support.

- Conduct monitoring and evaluation of the program to facilitate operational improvements.

The lessons drawn from Benin’s successful bond issuance illuminate a path toward more effective SDG financing solutions in Africa, offering timely insights and momentum as global leaders prepare to shape the future of development finance at FfD4 in Seville.

Learn more by reading the policy briefs: “Bridging the SDG Financing Gap: Benin’s Innovative Eurobond Experience” (in French) and “Strengthening School Feeding Programs to Improve Student Performance and Nutritional Status in Benin” (in French).